Credit Cards vs. Instant Personal Loans: A Comparison

- Comments Off on Credit Cards vs. Instant Personal Loans: A Comparison

- Finance

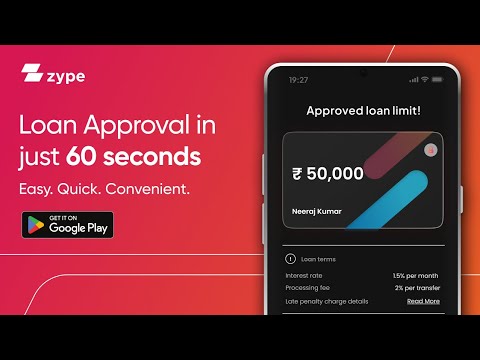

When it comes to the world of personal finance, the two go-to options are instant personal loans and credit cards. When it comes to accessing quick funds, while both offer their unique benefits and serve various financial needs, instant personal loans often come out ahead in key areas. This post delves deep into the reasons why instant personal loans can be a smarter choice over credit cards for specific financial circumstances.

- Fixed Interest Rates: This is the best thing that makes instant personal loans stand tall in comparison to credit cards is their fixed interest rate. Whereas credit cards usually offer variable interest rates and repayment terms. The predictability of interest rates makes it a better choice and simplifies budgeting, as you know how much you need to repay every month.

- No Impulse Spending: Credit cards are infamous for enabling and encouraging impulse spending. The ease of swiping cards and getting payments done often leads to overspending and accumulating stuff you never intended to buy. Whereas instant personal loans are disbursed for a specific amount and purpose, limiting the possibility of unintended purchases.

- Debt Consolidation: One of the strengths of early salary loan app that make them stand out from any other financial tools is their effectiveness in debt consolidation. Just imagine having multiple credit card debts with variable interest rates or an instant personal loan that can consolidate those debts into a single payment., often at a lower fixed interest rate. By employing this strategy, you can also save significantly over the long term.

- Defined Repayment Term: Instant personal loans always have a clearly defined repayment term and schedule, typically ranging from months to a few years. This structure helps develop disciplined repayment habits and offers a clear path to becoming debt-free. Meanwhile, credit cards only require minimum payments, which can extend the debt cycle and accrue heavy interest over time.

- Usage Flexibility: Credit cards often have categorical restrictions offering benefits on different things, encouraging you to spend impulsively. Instant personal loan apps India offer more versatility as you can use them for various purposes, including but not limited to medical emergencies, home renovations, and even education.

- No Hidden Fees: Credit cards often come loaded with tons of hidden charges, such as annual charges, late fees, and cash advance fees. In contrast to that, RBI registered loan app usually offer more transparent fee structures. Knowing upfront fees and what you’re expected to pay can make managing your finances more straightforward.

- Lower Risk of Over-Leveraging: Having a predefined loan amount with instant personal loan for salaried person naturally caps your borrowing capacity, reducing your risk of over-leveraging. Credit cards, with their open-ended nature, can lead you down a path of accumulating unsustainable debt over time.

While both instant personal loans and credit cards are good in their own right in your financial toolkit, understanding the unique advantages of each is essential for making informed decisions. Online salary loan app often excel in providing predictable and disciplined lending solutions for various needs, from debt consolidation to emergency expenditures. Making the right choice can serve as a significant milestone on your journey to financial freedom.