Money Management Is Easy With Online Mobile Finance Apps

- Comments Off on Money Management Is Easy With Online Mobile Finance Apps

- Finance

Financial planning plays an important role in everyone’s life. It is a day-to-day skill that can save you from a financial crisis. It can make financial life seamless, even when you have any early retirement plans. But planning finances strategically indeed needs detailed research. Also, some factors are mandatory that can vary from different age group’s financial planning. You may need to plan for investment or savings. Sometimes, you may also need to apply for a personal loan or credit card to fund your emergency needs.

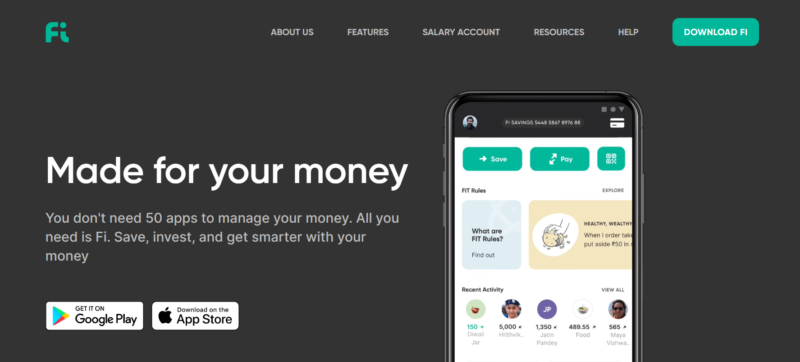

To get expert ideas for all these tough decisions on your own, you can get help from online financial apps. Online financial apps are one-stop solutions to plan your financial decisions based on the current economy and your financial condition. Are you looking to download a reliable and go-to financial or UPI payment app? Here are the details you should know before downloading one of those applications.

What are financial apps?

Financial apps are basically a detailed online interface with all kinds of financial tasks like open online bank account, applying for credit and debit cards, making investments, taking loans, etc. All of these apps are easy to use with their simple online interface, and they are ready to deliver convenience to the user.

As a user of these kinds of apps, you can even track your credit score, make online payment, check your bank balance, and track your financial goals. They can help with both the upkeep of budgets. Saving money and planning for the future can be made simpler in this way.

Features of online financial apps

Online financial apps usually include a few common features that can reduce financial hassles. Here, you can look at these features.

- You can go for all kinds of banking and non-banking tasks through these apps.

- Financial apps offer 24-hour banking assistance to you so that you can undergo a smooth and seamless financial journey.

- Financial apps make payment UPI and money transfers quite faster, and the transaction is always convenient.

- You can track bank account details, investment details, and any other money-related statements.

- You can stay cashless when you are equipped with online financial platforms. You can pay any merchant anytime from anywhere. You can also pay any monthly bills instantly.

- You are able to send money to any bank account from your bank account instantly.

- Financial apps have a secure interface. You need to log in to your account with the proper ID, password, and other credentials. These applications are end-to-end encrypted with a multi-layer security system. There is no or less chance of fraudulent activities on your accounts.

- You will receive timely notification of any transaction or any changes in your profile. It can have everything you need in a payment app.

- In case you have more than one bank account, you can add all of those together in one app interface. It will help you to keep your money together whenever needed.

- Financial apps are helpful for monitoring all kinds of digital assets like online gold investments, commodity investments, etc.

What are the benefits of mobile financial savings apps?

- You can save time by doing all your banking stuff from your own home. You do not need to go to any bank or other financial offices for any work.

- You can enjoy instant transfer of money to any bank account or any merchant. Bill payments are easy, too.

Conclusion

The digital revolution makes every task easier than in past days. Banking tasks are no exception. These cutting-edge features of financial apps are changing the financial industries significantly. In the upcoming days, the whole financial industry is going to experience huge changes in order to deliver huge benefits to their users.